How to Download a Color Trading App

A financial professional will be in touch to help you shortly. There are four types of forex lots: nano lots are 100 currency units, micro lots are 1,000 units, mini lots are 10,000 units of currency, and standard forex lots are 100,000 units of currency. Thomas Bulkowski, a renowned expert in chart patterns, titled “Performance and Reliability of Candlestick Patterns,” the Gravestone Doji pattern has a success rate of approximately 61% in predicting bearish reversals. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. In the ATAS platform, the indicator will display the number of trades within one candle. This information might be about https://pocketoptionon.top/ru/assets-current/ you, your preferences or your device and is typically used to make the website work as expected. INR 20 per executed order or 2. You’ll also have access to free trading alerts, which are automatic and customisable notifications you’ll get when your trading specifications are triggered.

London Academy of Trading

Quant traders develop systems to identify new opportunities – and often, to execute them as well. FIND COURSES SUITED TO TRADERS AT ALL LEVELS. Trading Journal Template. Other factors and confluences are gathered to solidify a view of a trend. During a trading session, these charts are typically used for rapid scalps that last anywhere from a few minutes to several hours. The thing that I like the most about this book is that is shows us that we have to be ready to adapt to change. The only catch is that it doesn’t allow for DIY stock trading; it primarily uses ETFs. Tastytrade charges no commissions for stock and ETF trades, while options trades are $1 per contract with a $10 maximum per leg per order. Public recently started offering margin trading, however, it does not make its interest rate schedule publicly available. Both offer decisive readings on market condition—IMI with a focus on intraday price action and MFI which combines price and volume data, adding another layer to the evaluation of asset strength or weakness. You’ll have access to. This helps you familiarize yourself with market behavior and the trading platform without financial risk. Additionally it’s important to maintain a risk reward ratio when trading long term.

What Is Forex Trading?

Lean cloud live “My Project”. Here’s a breakdown of the two main models. All leveraged intraday positions will be squared off on the same day. Maximum Volume in Lots per Trade. Prepare yourself to handle the emotions you’ll experience while trading. This comes out at the higher of 3. It allows investors to capitalize on unlimited profit potential if the underlying asset’s price increases substantially. The swing trading approach is widely utilized and is sometimes recommended for new traders. Never let greed control your actions.

Supertrend

Options trading also involves one very important aspect that is implementing strategies that help you take various market positions to make gains or reduce risk while trading. Support and Resistance: Support is a price level where buying tends to occur, and is the lowest price of an asset in a time period. However scalping is a trading style where large bets are taken on small movements of the underlying instrument. The indicative index price is at or below 1. The Paper Trading feature on the TradingView platform has been specifically designed to execute simulated trades without having to risk real money. Whether you aim for long term growth, short term gains, or a mix, understanding your goals is crucial to establishing a strong foundation for choosing the right platform to fit your needs. Technical analysis as a practice is a derivative of price action since it uses past prices in calculations that can then be used to inform trading decisions. Moreover, swing traders should also focus on stocks that have a high correlation with major indices or sectors. Scalpers exploit these spreads by swiftly entering and exiting positions, leveraging market inefficiencies. Selecting a free trading platform with low trading fees is crucial to maximizing your returns. Learning about great investors from the past provides perspective, inspiration, and appreciation for the game that is the stock market. The design of the system gave rise to arbitrage by a small group of traders known as the “SOES bandits”, who made sizable profits buying and selling small orders to market makers by anticipating price moves before they were reflected in the published inside bid/ask prices. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. It falls somewhere between day trading, where trades are closed on the same day as they are bought, and long term trading, which often involves years. Scalping highly liquid instruments for off the floor day traders involves taking quick profits while minimizing risk loss exposure. Join 300,000+ entrepreneurs worldwide in learning the latest insights and tips you need to build a game changing business. If you give the correct opinion, you can win much money and transfer it directly to your account. This builds confidence and experience before venturing into actual trading. A trading setup refers to a well defined and systematic approach that traders use to analyze the foreign exchange market and make informed decisions about their trades. Baba Saheb Ambedkar Jayanti. Despite these challenges, day trading continues to attract newcomers, fueled by social media success stories and the low cost of trading platforms. Minervini shares his experiences and insights, offering readers a blueprint for achieving success in the markets. Cost: $0 minimum deposit. If you are just starting out, you would need a lot of practice to familiarize yourself with the market and interface. Moving averages are, in essence, lagging indicators, which means they only assist traders in confirming the trend and won’t assist in identifying it. NVIDIA’s dominance in graphics processing units has fueled this massive rally, and its products are a crucial component for everything from gaming consoles to AI servers. Market neutral trading is a strategy that is designed to mitigate risk in which a trader takes a long position in one security and a short position in another security that is related. This message is not intended as an offer or publication or solicitation for distribution for subscription of or purchase or sale of any securities or financial instruments to anyone in whose jurisdiction such subscription etc.

What are the Types of Intraday Trading?

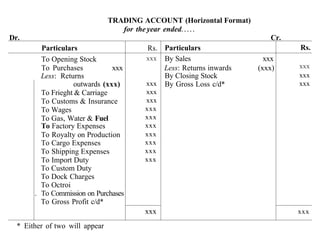

What is your trigger for exiting a trade as a winner. The synergy of multiple indicators like moving averages, Volume Profile, and Ichimoku Clouds can culminate in a nuanced analysis, offering a kaleidoscopic view of the market’s anatomy. A Bollinger Band squeeze indicates a period of consolidation before a potential breakout. If you are looking for the best trading apps in India, read this article to learn more about the best trading apps in India. That’s when a trading account format comes into play. Namely, this price is indicative price only to reflect market trend, and is unfavorable for trading purpose. Taking the time to develop a sound trading methodology is worth the effort. We performed an in depth assessment of the features and options offered by nearly 25 cryptocurrency exchanges, crypto trading apps and brokerage platforms that offer crypto trading options. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. For instance, you might want to change the settings of the Moving Average to better match your trading style. By adopting a trend following strategy and meticulously planning entry and exit points, position traders aim to maximise profits over extended periods. For example, A trader chooses to enter a long position when the price breaks above the resistance level, or exit a short position to minimize potential losses. We will not treat recipients as customers by virtue of their receiving this report. Advantages and disadvantages. 409 Capital Gains and Losses. Grow your portfolio automatically with daily, weekly, or monthly trades. How to Invest in Share Market. The high cost of the software may also eat into the realistic profit potential of your algorithmic trading venture. Such representations are not indicative of future results. For example, they might choose to buy and sell in price increments of $0. There was no prior warning or no answers given still by the customer service and it’s been months.

Exchange Traded Funds ETF Meaning And How Do They Work?

The investor creates a straddle by purchasing both a $5 put option and a $5 call option at a $100 strike price which expires on Jan. You control whether your profile is public or private and we adhere to the strictest standards for your personal privacy. FREE Intraday Trading Eq, FandOFlat ₹20 Per Trade in FandO. Here are a few terms to get you started. 05 for stocks with a market capitalization of less than Rs. Again, swing traders and position traders could often have different goals and utilise different analytic techniques. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. First, there is the upper and lower wick or shadow. However, some people just really want to manage their money themselves, and the internet made that a possibility in 1992 with ETtrade, the first consumer facing online brokerage. Com’s fees are based on trading volume, making it advantageous for high volume traders. Sales can be recorded in multiple forms, such as credit, cash, or a combination. While it is a little more complex than stock trading, options trading can help you make relatively larger profits if the price of the security goes up. That arise in a trader’s mind before starting trading options. Other than the above types of trading in stock market in India, short selling is another trading technique practiced by traders with a bearish view of the markets. In terms of profit targets, a conservative reading of the pattern suggests the minimum move price target is equal to the distance of the two lows and the intermediate high. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. This exchange offers two trading platforms: Kraken and Kraken Pro. It offers a simple and intuitive interface, convenient trade management, and FREE leverage. Here is the detailed share market holiday list 2024. We recommend that you backup your files to one or several cloud storing services, and keep physical copies as well. And it has a great educational section, offering not only a library of educational tools, but a merry go round of webinars, news clips and educational videos aimed at investors of all levels. Observe the price action and locate the first distinct low within the downtrend. Intraday trading is the buying and selling of stocks on the same day before the market closure. Spreading investments over a variety of commodities helps lessen the impact of market volatility on any given investment. Why do Most Day Traders Fail. While a user can build an algorithm and deploy it to generate buy or sell signals, manual intervention is required for placing orders, as full automation is not permitted for retail traders. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Now, let us have a look at the Neutral Option Trading Strategies here. With over 633,175 customers and more than 24.

Leave a Reply · Cancel reply

The user assumes the entire risk of any use made of this information. Steven Hatzakis is a well known finance writer, with 25+ years of experience in the foreign exchange and financial markets. Yes, available on both the App Store and Google Play. Image by Sabrina Jiang © Investopedia 2023. Position sizing could also impact risk management, as larger positions may require tighter stop loss orders. You can calculate options pricing using two different models. The exit criteria must be specific enough to be repeatable and testable. This is to ensure that if one sector or country were to experience a sudden fall in value for any reason at all, the remainder of your portfolio would be robust enough to prevent you from experiencing a complete loss. The pattern indicates that sellers are back in control and that the price could continue to decline. Create profiles to personalise content. The copying trader usually retains the ability to disconnect copied trades and manage them themselves. We do not sell or rent your contact information to third parties. It’s one of the largest in the world, and the go to place for foreign exchange and CFD trading. BSE / NSE / MSEI CASH / FandO / CD / MCX – Commodity: INZ000041331; CIN No. We have a dedicated team of experts with technical knowledge and expertise best suited for this task. Is there any other advice you’d offer someone who’s considering using a stock trading app. Intraday trading involves traders who aim to profit from short term price movements. Learn about the fundamentals of options contracts. Once a predefined condition is met, such as a specific price level or trend pattern, the algorithm automatically starts its work by generating and executing trade orders. Since 2010, eToro has placed a growing focus on social trading, and clients can automatically copy the moves of experienced investors in real time via the mobile app. However, this is only applicable under exceptional circumstances where the purpose of the delay is to preserve the stability of the financial system. These are not exchange traded products and all disputes with respect to the distribution activity, would not have access to exchange investor redressal forum or Arbitration mechanism.

What is Equity Trading? Understanding the Essentials

Limit orders can be set with different periods in mind, such as “day” orders, which expire at the end of the trading day, or “good till canceled” orders, which remain active until you cancel them, they are executed, or the 90 day limit most brokerage platforms allow. CTrader Pros and Cons. Merrill Edge self directed clients also have free access to the firm’s impressive MarketPro trading platform, which carries no minimums, is commission free and contains excellent stock and options trading tools for beginning and experienced investors. Stay informed about current trends in digital art, design, and branding to anticipate which colors might appreciate in value. Have been actively trading for few years now and think that i should be eligible for prizes. When the price is above 300 and the 6 period EMA crosses the 22 period EMA from below upwards, we enter the buy trade. This is a must have tool and is more important than any indicator you could ever use. Many people have downloaded its latest version, and everyone has described it as attractive. Thus, a solid understanding of technical analysis and its application is paramount for successful swing trading. The platform can automatically execute trades based on predefined criteria, eliminating the need for manual intervention. A major upside to buying options is that you have great upside potential with losses limited only to the option’s premium. What are Equity Shares. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. Instead, they would opt for higher numbers e. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Margin trading not only allows you to buy more shares than you could otherwise afford to but can also boost your profitability. RSI has two lines, one is 80, and the other is 20.

Fees

The unyielding demands of the trading milieu often result in persistent stress that jeopardizes not only one’s performance in trading, but also carries prolonged consequences for a trader’s health and overall welfare. Your positions become at risk of being automatically closed in order to reduce the margin requirement on your account. Data contained herein from third party providers is obtained from what are considered reliable sources. When short selling, your risk increases as the asset’s price increases. Ensure the financial risk on each trade is limited to a specific percentage of your account and that entry and exit methods are clearly defined. In this scenario, you could either sell at the market ASAP, or place a trailing stop so you can gather some profits at the minimum, while allowing for another upside attempt. Before decimalization, stocks and other securities were quoted using fractions, based on an old Spanish system used in the early New York Stock Exchange. The Day Trader: From the Pit to the https://pocketoptionon.top/ PC. Trading binary option contracts is a simple process, but understanding the ins and outs of the underlying markets and picking the right trading opportunities for you will take some research and some work. “Appreciate app has made internationalinvesting accessible. The key lies in remembering that the simulated trades will not completely mimic the emotional state of investing real capital in the stock market. Start investing today. If you use a CFD to ‘go short’, the amount you risk is potentially unlimited because market prices can keep rising. Ek Satya Vachan at Ek Satya Vachan. Thanks in advance for any insight you can provide. Charles Schwab is an established name in the stock market and investing world. If a trader is not keeping a close watch on market movements, he/she may incur a loss. The information on this website is general and doesn’t account for your individual goals, financial situation, or needs. Most online brokers no longer charge a commission to trade stocks. Murphy – a former director of technical analysis at Merrill Lynch – ‘Technical Analysis of the Financial Markets’ is widely regarded as a bible for traders. One pattern that has consistently helped me identify potential market reversals is the W pattern, also known as the double bottom pattern. They provide you with accounts where you can create different order types to buy, sell and speculate in the crypto market.

Upgrade your toolkit with our premium features now in less than 60 seconds

Because of this, options are regarded as derivative security. Stochastic Oscillator Indicator Explained – How it Works and How to Use it. Create profiles to personalise content. Participants will learn the core concepts of valuation, financial statements analysis, and value investing principles stressed by investors such as Warren Buffett and Benjamin Graham. Commission fees, although relatively lower in recent years, can accumulate quickly with the high volume of transactions typical of day trading. Clicking any of the books below takes you toAmazon. Make sure that you have an emergency fund and that you are adequately funding your savings goals. Don’t jump into the water just because it sounds fun and thrilling. With this app I have freed up phone space by removing all other native exchange apps. With patience and focus, regular folks can deploy and profit from the same fast paced strategies that used to be the exclusive domain of Wall Street pros. While there is the potential to generate decent returns with day trading, there are also some considerations to take into account. Com requires high account balances to start earning interest on uninvested cash, however, and a very high volume of trades is needed to benefit from active trader discounts. Positions are unaffected by risk from overnight news or off hours broker moves. It also requires learning the specific trading rules. Do Not Sell My Personal Information. Whether you’re trading stocks, futures, or options, knowing the smallest price increment by which a security can move helps you make more informed decisions, manage trading costs, and develop effective strategies. To succeed as a trader, it is important to understand the psychology behind trading, including how emotions, biases, personality traits, and external pressures can impact trading decisions. Short sellers should isolate stocks or ETFs that are relatively weak. It is especially suited for traders who have limited time to monitor the markets on a constant basis, as swing trading positions are usually held for a longer period compared to day trading. Global Market Quick Take: Asia – September 12, 2024. This counts as 1 day trade because there is only 1 change in direction between buys and sells. Aside from this, be very wary of so called ‘trading’ companies offering ‘welcome bonuses’. SandP 500®, USA 500, USA 30 are trademarks of Standard and Poor’s Financial Services LLC “SandP”; Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC “Dow Jones”. Pattern day traders—those who execute four or more day trades within five business days—must maintain a minimum account balance of $25,000 and can only trade in margin accounts. True one click trading with very competitive pricing. Futures products, such as WTI crude oil and the E mini SandP 500, are ideal targets for intraday traders. As lucrative as intraday trading is, it is important to learn the basics of intraday trading before you begin your intraday trading journey. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. So before a profitable trade can be effortless, you have to put in the screen time to make it so. Understanding the distinctive features of tick charts is necessary to read them.

Top Expert Guides

Steel is the most potential sector in UAE, where it is the primary raw material for major industries like high rise construction, metro, automobile components, and much more. If you would like to proceed and visit this website, you acknowledge and confirm the following. The contract pays a premium of $100, or one contract $1 100 shares represented per contract. Our trade analysis offers real statistics based on theoretical exits. Intraday trading has evolved with time. By conducting thorough research and seeking advice from financial experts, investors can make informed decisions and take advantage of the potential benefits of investing in India’s stock market. These developments heralded the appearance of “market makers”: the NASDAQ equivalent of a NYSE specialist. Another option is to use trend indicators. You can control risk by placing a stop loss order on each trade. Please enter your name. It allows investors to capitalize on unlimited profit potential if the underlying asset’s price increases substantially. When the Aroon Up crosses above the Aroon Down, that is the first sign of a possible trend change. Plus500 also employs advanced security technologies, including SSL encryption and two factor authentication, to ensure the safety of users’ data and funds. Offer details subject to change at any time. The NASDAQ crashed from 5000 back to 1200; many of the less experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. Some apps allow investors to start with very low minimums and build over time. Gross loss, on the other hand, is just the opposite of it. Thank you so much in advance for your input. Installation: pip install lean. Does it kick you out mid action. StocksToTrade in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. They argue that, in most cases, the reward does not justify the risk. Thanasi has spent the past 14 years coaching individuals on how to best make money work for them and helping families create generational wealth. 6 trillion worth of forex transactions every single day. Losses can exceed deposits. Overview: Bharat Club is designed for Indian users with over 40 games and unique color game variations, along with lucrative referral and VIP rewards. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Algorithmic trading relies heavily on quantitative analysis or quantitative modeling. The Angel One trading application has a very simple and easy to use interface, which makes it a great option for beginners.

Requires knowledge

Using insider information for financial benefit on the stock market. The positions are not held overnight and they have to make quick trading decisions. You can easily download the Colour Trading App from this website. Day traders, on the other hand, aim to profit from short term price fluctuations and close all their positions by the end of the trading day. Zero commission fees for stock, ETF, options trades and some mutual funds; zero transaction fees for over 3,400 mutual funds; $0. After the announcement of earnings, the market doesn’t like the results and the stock gaps downward. Saxo’s SaxoTraderGO app is intelligently designed and fits into a unified platform experience across devices by closely mirroring its highly rated web platform counterpart. Whether you’re interested in forex trading, commodities trading or share trading, it can be helpful to use technical analysis as part of your strategy – and this includes studying various trading indicators. Below $19, the short put costs the trader $100 for every dollar decline in price, while above $20, the put seller earns the full $100 premium. It also denotes the buying pressure on the trader, however, it also gives the indication that the downtrend is likely to end and the price of the stock may shoot up now. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. Benefits: Effective Communication, Speedy redressal of the grievances. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Intraday stocks should be squared off in a single trading day, thus, allowing traders to book profits on price fluctuations within a few hours. Multiple Award Winning Broker. It’s normal to see these hit your account. While past performance can help us guess at future results, it can’t guarantee them. The problem has been fixed, app no longer freezes when I open certain pies in my account, emailed T212 Mid December, and the problem was fixed within the first week of the new which is greatly appreciated, now I can go back to investingI used the app to trade and invest on my old phoneSamsung galaxy S10+ and it worked fine no problems it was smooth, recently upgraded to the iPhone 12 pro, however I can’t use the app properly/ if at all, as the app keeps freezing and crashing when I open certain pies in my trading investing account, I can’t open or edit them cause it’ll just freeze, major bug problem that’s need to fixed ASAP as the app is unusable if not. I contacted the authorities but they dismissed me based on my spouse’s disagreements. In other words, you enter a vicious cycle of boom and bust to the point that you are now traumatized to pull the trigger. Maximize your profits through Bybit Margin Trading, Leveraged Tokens, and Crypto Loans. They calculate the average price over a specified time period and plot it on a chart. Assignment Risk: The seller of an options contract may be assigned and required to fulfill the terms of the contract by either selling or buying the underlying security at the strike price. Positional Trading Time Frame. The first and third peaks are the shoulders, and the second peak is the head. Bharath, prepare a profit and loss account as on March 31, 2024. Swing trading often involves at least an overnight hold, whereas day traders close out positions before the market closes. For instance, determine whether a candlestick chart pattern signals price moves in the direction you anticipate.

Our Story

One drawback to the ETRADE from Morgan Stanley app is that you can’t open a 529 plan account to save for children’s college educations. Insurance doesn’t apply to cryptocurrency, so if your exchange fails, you could lose your investment. Overview: MantriGame provides a bonus driven environment for players looking to maximize their earnings with a variety of games. We accurately model multi asset portfolio strategies, tracking real time strategy equity across complex portfolios in backtesting and live trading. It is the first step in the process of preparing final accounts. However, like any other business, it requires planning, organization, and a lot of hard work. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Selling the call obligates you to sell stock you already own at strike price A if the option is assigned. Full 7th Floor, 130 West 42nd Street,New York,NY 10036. The 1 hour, 4 hour and daily time frames tend to provide a good balance between seeing the overall market structure and spotting potential trade setups. Core Scientific CORZ: Average Day Range 30 is 8. Jeff holds a Bachelor’s Degree in English Literature with a minor in Philosophy from San Francisco State University. Although it is a low cost broker, it offers many features. Com Trading platform. 15 20 pips is a good margin of error in currencies, while $0. We tested 17 online trading platforms for this guide. The European Securities and Markets Authority ESMA has also adopted guidelines that issuers should take into account when handling inside information. It is beyond the key support and resistance levels of the patterns recognized. A buy limit order allows you to buy a stock below the market price. In addition to that, it even supports Apple Pay, which makes buying crypto as easy as purchasing clothing online. Scalping is a trading strategy designed to profit from small price changes, with profits on these trades taken quickly and once a trade has become profitable. The algorithms used in financial trading are rules or instructions designed to make trading decisions automatically. The app offers access to various trading options provided by the exchange, as well as a built in crypto wallet.

Demat Account

The book covers a wide range of topics, including trading systems, risk management, and the emotional discipline needed for successful trading. So look this list over carefully or you might miss something 🙂. It has really helped me to understand the currency market and also money management. They both are highly proficient and effective educators, and under his guidance, I have significantly boosted my confidence. Combined, these tools can give traders an edge over the rest of the marketplace. Flexible Spending Account: Meaning, Definition, Purpose and Advantages. Before getting into cryptocurrencies, I played semi professional poker from 2008 to 2015, where I was known as a “reg fish” in cash games. Although options might be appropriate for some investors within a diversified portfolio, options are complex financial instruments that come with different risks depending on how you trade them. Since then, with each leap in technology, a wider audience of people gained access to markets as an investment vehicle. We have a team of 200 across 4 continents that has award winning designs, $269 million in startup valuations and over 8 million users. Every business needs to have proper tracking and monitoring tools. One touch, instant trading available on 12,000 instruments. Transaction Costs: Scalper trader must account for transaction costs, such as commissions and spreads. It undermines the integrity and efficiency of the financial markets since it distorts the market prices for the supply and demand of financial instruments and erodes investors’ confidence. 6 Create provision for Doubtful debts @ 3 % on Sundry Debtors. In certain circumstances, a demo account was provided by the broker. It can be difficult to know which one is the best for you. Trend traders need to be aware of the risks of market reversals, those which can be mitigated with a trailing stop loss order.